A statement of comprehensive incomeThis may be presented as a single statement or with a separate statement of profit and loss and a statement of other comprehensive income. These funds invest in commodities derivatives hedge funds etc.

Valuation Of Tangible Fixed Assets Powerpoint Slides

This expense charged every year is called depreciation.

. According to ASC 360-10-35-32c if an asset groups primary asset is not the asset that has the longest remaining useful life estimates of future cash flows for the asset group should be based on the assumption that the asset group will be sold at the end of the remaining useful life of the primary asset. Malaysia 60 Mexico 64 New Zealand 68 Singapore 70 South Africa 75 South Korea 80 Spain 83 Taiwan 86 Thailand 88 The Netherlands 90 Turkey 94 United Kingdom 98 United States of America 102 Contents. The accounting for this will be.

Replacement Cost Actual amount required to repair or replace your vehicle minus depreciation. Depreciation rate or effective life. The term includes such crimes as burglary larceny and robbery.

Monthly depreciation using the full month averaging method. Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred. Balanced funds invest in all asset classes which include equities fixed income securities and money market instruments.

A recent HK7337 million 935 million investment into a Japanese equity exchange-traded fund ETF involved a Hong Kong-based asset owner who sought to take advantage of the sharp depreciation of the Japanese yen against the strong dollar AsianInvestor has learnt. The VAT rates are 23 standard rate 8 5 0 and exemption. All fields are mandatory.

To use this method the following calculation is used. A statement of financial position balance sheet. Get 247 customer support help when you place a homework help service order with us.

Enter a rate of 20 the annual depreciation for the first three years is. You need to choose one of depreciation rate or effective life. Hence some will think that they had bought a loss-making investment property.

However other criteria could be adopted if there are. Generally depreciation is calculated by the straight-line method. This method of calculating the depreciation of an asset assumes that it depreciates uniformly in value over its effective life.

Every year a small portion of its cost is expensed and is allowed to be reduced from your income. The annual allowance is given for. A statement of changes in equity.

Lease rentalinterest When you look at a lease agreement it should be relatively easy to see that there is a finance. When you assign an asset type to a new fixed asset the types settings are automatically applied to the asset. Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more.

Dr Depreciation expense Cr Accumulated depreciation. While annual allowance is a flat rate given every year based on the original cost of the asset. The risk varies depending on the allocation of the asset classes.

Presentation of financial statements. Depreciation of fixed assets. Theft - The unlawful taking of property of another.

No longer able to support its exchange rate the government was forced to float the Thai baht which was pegged to the US. The tax legislation only provides a 2 rate of tax depreciation per year for immovable property except for land. MYR 2490 in August 2012.

The investment was made into the ChinaAMC MSCI Japan Hedged to USD ETF. Under-Insurance - A condition in which not enough insurance is purchased to cover the total cash or market value of the insured asset. First year 260.

Such assets are capitalized and not charged to expenses when they are bought. The standard 23 VAT rate generally applies to the supply of all goods and services except for those that are covered by special VAT provisions that provide other rates or treatments. Fixed assets with useful lives of more than 12 months must be capitalised and depreciated in accordance with the CIT regulations.

Tax accounting workflow and firm management solutions to help your firm succeed with the research tools you need to stay sharp. A statement of cash flows. This is referred to as the residual value of the asset group.

Property owners have two ways of calculating depreciation on their assets. IFRS financial statements consist of. After recognizing any resulting impairment the reporting entity should then revise its future depreciation to.

Calculations must be performed quarterly. For example if the depreciable value of an asset is 1300 and you. If a reporting entity commits to a plan to abandon a long-lived asset before the end of its previously estimated useful life it should first test the asset for impairment under the held-and-used impairment guidance of ASC 360-10 ie at the asset group level.

Alternative Investment Funds are less common in Malaysia. If a depreciation of 41 year to date is not scary enough over the past 10 years the depreciation is an astonishing 227 falling from SGD 1. Depreciation When you purchase a capital asset the benefit of such an asset is usually expected to last more than a year.

Even if they are able to sell the property at their purchase price the depreciating Ringgit against Singapore Dollar will. Finance is the study and discipline of money currency and capital assetsIt is related with but not synonymous with economics the study of production distribution and consumption of money assets goods and servicesFinance activities take place in financial systems at various scopes thus the field can be roughly divided into personal corporate and public finance. On July 2 1997 the Thai government ran out of foreign currency.

Assets cost days held 365 100 assets effective life. Worldwide Real Estate Investment Trust REIT Regimes Compare and contrast 3 During the past years Real Estate Investment Trusts REITs have had a strong. Production-nature biological assets such as livestock held for breeding and commercial timber also have to be.

For other assets the tax legislation does not provide any lives or rates. Annual depreciation by multiplying the depreciable value of the asset less previous depreciation by the depreciation rate. Supplies covered by a reduced rate of 8 include among others supplies of pharmaceutical products and passenger.

In general terms accounting criteria are followed to calculate tax depreciation. Following the initial capitalisation of the leased asset depreciation should be charged on the asset over the shorter of the lease term or the useful economic life of the asset. You can edit the depreciation settings for a particular asset but you cant change the accounts.

The financial crisis heavily damaged currency values stock markets and other asset prices in many East and Southeast Asian countries. Capital allowances consist of an initial allowance and annual allowance. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Market Outlook Manulife Investment Management

How To Use Balance And Income Statements For Your Business 2022

Valuation Of Tangible Fixed Assets Powerpoint Slides

Finance Life Events Guides Financial Literacy And Money Management Credit Card Infographic Credit Card Fees Financial Literacy

Training Modular Financial Modeling Ii Corporate Taxation Detailed Modeling Tax Losses Modano

Pallet Racks Are Intended For The Standardized Storage Of Different Types Of Pallets And Are The Most Used Solution For Pallet Rack Warehouse Equipment Pallet

Ts Grewal Accountancy Class 11 Solutions Chapter 15 Financial Statements Of Sole Proprietorship Ncert Solut Sole Proprietorship Financial Statement Solutions

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Asset Calculator

Sage Fixed Assets Services Sage Professional Services

Fixed Asset Schedule Meaning Elements Format And Benefits Fixed Asset Accounting Finance Lessons

Valuation Of Tangible Fixed Assets Powerpoint Slides

3 Fundamental Question For Accountant In Malaysia 1 Fundamental Accounting Financial Year End

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Projected Balance Sheet Template Excel Projected Balance Sheet Template Excel Templatezet Balance Sheet Template Balance Sheet Resume Template Examples

Accounting Standards Related To Fixed Assets Read Full Article Read Full Info Http Www Accounts4tutorials Com 2015 Fixed Asset Accounting Intangible Asset

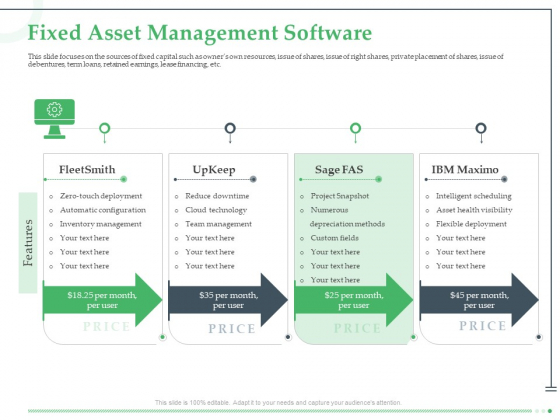

Funds Requisite Evaluation Fixed Asset Management Software Structure Pdf Powerpoint Templates

Valuation Of Tangible Fixed Assets Powerpoint Slides

:max_bytes(150000):strip_icc()/dotdash-INV-final-Absorption-Costing-May-2021-01-bcb4092dc6044f51b926837f0a9086a6.jpg)

/dotdash-INV-final-Absorption-Costing-May-2021-01-bcb4092dc6044f51b926837f0a9086a6.jpg)